Just Say No To Bad Financial Advice

Marine Veteran & Forbes-Featured Advisor Reveals the Model Q™ System That's Saved Clients $47M+ in Unnecessary Taxes

Also available on Kindle for $9.99

$47M+

Saved for Clients

3,800+

Transactions

30+

Years Experience

Discover What's Inside

30+ years of experience and 3,800 transactions condensed into one powerful book

The Model Q™ System

My proprietary income planning methodology that prioritizes cash flow over assets

Chapter 12: FedEx Route Exit Strategies

Save 30-40% on taxes when selling your routes with strategies most advisors don't know

537 IST Strategy

The tax-free exit strategy that's helped dozens of my clients save millions

Real Case Studies

From my 3,800+ successful transactions showing exactly how we saved clients money

Why Traditional Advice Fails

Expose the myths that cost you millions and learn what actually works

CB Farmers Trust Program

The little-known trust strategy that provides guaranteed income and tax benefits

Who This Book Is For

Discover if you're one of the people who can benefit most from these strategies

FedEx Route Owners

Planning your exit and want to keep more of your hard-earned money

Medical Professionals

Paying too much in taxes and need strategic financial planning

Business Owners

With businesses worth $1M-$50M looking for tax-efficient exit strategies

Real Estate Investors

Tired of 1031 exchanges and looking for better alternatives

Near-Retirees

Who want to retire without running out of money

Skeptics

Who question traditional financial advice and want the truth

About the Authors

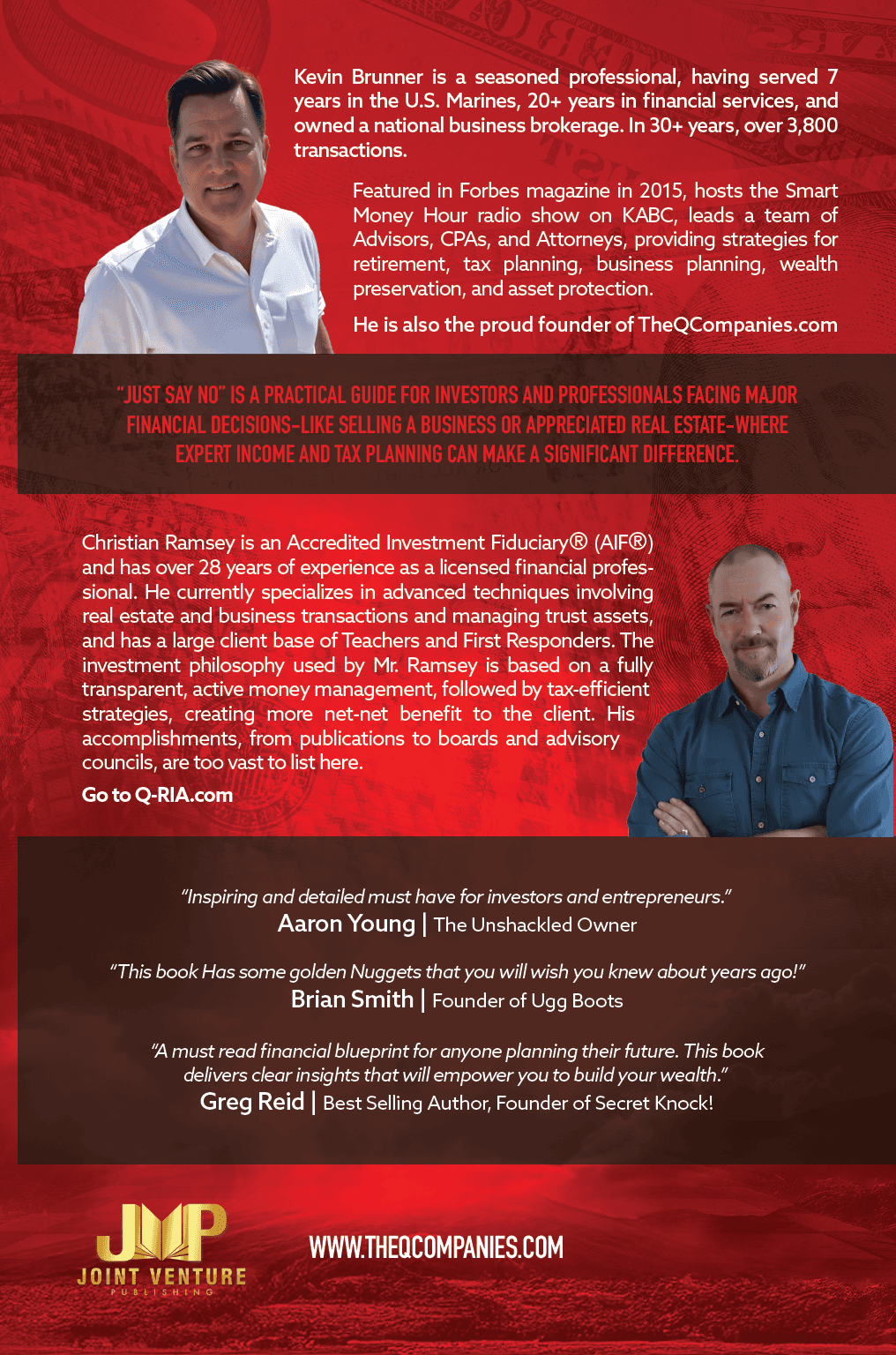

Kevin Brunner

Kevin Brunner isn't your typical financial advisor. A Marine veteran with 30+ years experience and 3,800+ successful transactions, Kevin has saved his clients over $47M in unnecessary taxes using strategies most advisors won't tell you about.

Featured in Forbes and host of the Tax Hax podcast, Kevin wrote this book to expose the truth about financial advice and share the Model Q™ System that's revolutionizing retirement planning.

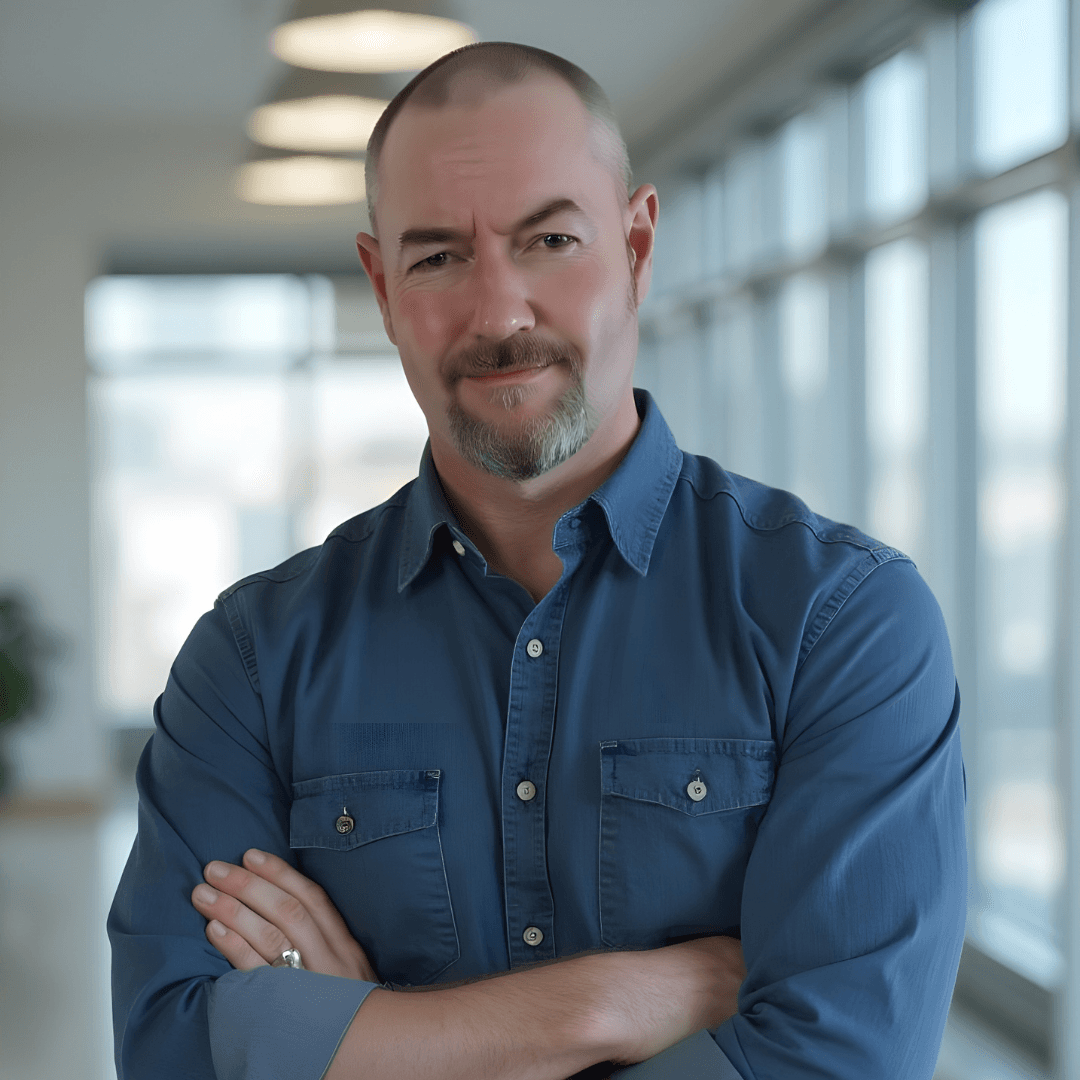

Christian Ramsey

Christian Ramsey is an Accredited Investment Fiduciary® (AIF®) and has over 28 years of experience as a licensed financial professional. He currently specializes in advanced techniques involving real estate and business transactions and managing trust assets, and has a large client base of Teachers and First Responders.

The investment philosophy used by Mr. Ramsey is based on a fully transparent, active money management, followed by tax-efficient strategies, creating more net-net benefit to the client. His accomplishments, from publications to boards and advisory councils, are too vast to list here.

3,800+

Transactions

$47M+

Tax Savings

58+

Combined Years

1,000+

Happy Clients

Table of Contents

Each chapter reveals strategies that could save you hundreds of thousands

Chapter Overview

Introduction to Model Q™

For: Everyone

Doctor Tax Optimization Strategies

For: Medical Professionals

Roth Conversions Done Right

For: Retirees

Business Exit Planning Secrets

For: Business Owners

Why 1031 Exchanges Are Killing Your Wealth

For: Real Estate Investors

FedEx Route Exit Masterclass

For: Route Owners

The DST Strategy Nobody Talks About

For: High Net Worth

Plus: Real case studies, tax calculators, implementation guides, and more...

Readers Are Saving Millions

Real reviews from real readers who applied the strategies in this book

Chapter 4 alone saved me $280,000 in taxes. I had no idea these strategies existed until I read Kevin's book.

Dr. Sarah Mitchell

Cardiologist

The Model Q™ System changed everything for my retirement planning. I'm now set up to exit tax-free.

Mike Rodriguez

FedEx Route Owner (8 routes)

Finally, honest advice backed by real math. Kevin doesn't just tell you what to do, he shows you why it works.

Jennifer Chen

Business Owner

I implemented the 537 IST strategy from the book and saved $1.2M on my exit. Incredible value.

Tom Harrison

Route Owner

This book exposed strategies my CPA never mentioned. Now I keep 40% more of my income.

Dr. Robert James

Orthopedic Surgeon

Chapter 11 about 1031 exchanges opened my eyes. I've completely changed my investment strategy.

Lisa Thompson

Real Estate Investor

Help Us Reach #1 on Amazon

Order during launch week and receive exclusive bonuses worth over $600

Launch Week Bonuses

Model Q™ Masterclass Webinar

Private 90-minute deep dive into advanced tax strategies ($497 value)

Tax Savings Checklist

Comprehensive PDF with immediate action items ($97 value)

Priority Strategy Session

Jump to the front of the consultation queue (Priceless)

Claim Your Launch Week Bonuses

Don't Wait Another Day to Save on Taxes

Every day you delay costs you money. The strategies in this book have saved my clients $47M+ — strategies your current advisor probably isn't telling you about.

Also available on Kindle for $9.99

30-Day Money-Back Guarantee

If you don't save at least 10x the book price using these strategies, return it for a full refund through Amazon. That's how confident I am this will change your financial future.

Strategy Session

ET • 30 minutes

In this 30-minute call, we'll create a personalized growth roadmap to help you save thousands in taxes.

Contact Information

💡 No pitch, no pressure

Just a strategic conversation about your tax savings potential